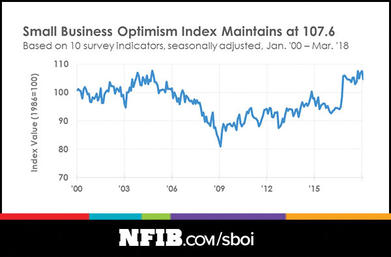

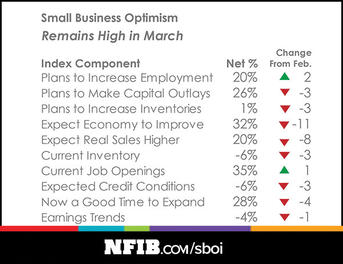

March was the 16th consecutive month of historically high small business optimism as measured by the National Federation of Independent Businesses’ (NFIB) Small Business Economic Trends survey. The survey showed that the optimism rating fell slightly from 107.6 on the NFIB Index in February to 104.7 in March, which is still among the highest readings since 1982. NFIB President and CEO Juanita Duggan noted that, for the first time in 35 years, taxes received the fewest number of votes as the biggest issue facing small business owners.

“For the longest time, small businesses’ biggest problem has been taxes and regulation, but now it’s the availability and quality of labor,” Mark Vitner, managing director and senior economist at Wells Fargo, said. “That’s been rising over time, and a very large portion of businesses say they have job openings that they have been unable to fill and that they’ve had fewer or no qualified applicants for those jobs.”

With the unemployment rate steadily decreasing nationally for the last several years, the labor market has tightened, Vitner explained. Additionally, he said many people are migrating toward higher paying occupations, higher paying positions and jobs that offer more security, which tightens the labor market even more for small business owners.

Despite the tight labor market, Vitner noted that small businesses are currently adding employees at the fastest rate since the Great Recession ended. However, he said small business owners have invested a lot of “sweat equity” in their firms and would like to find employees who share their passion and commitment, which is not an easy task. Vitner said a decline in the birth rate during the recession will only exacerbate the situation.

“We have a few more years where we have a healthy supply of young people entering the workforce and coming of prime working age, and then it’s going to fall off a little bit,” Vitner said.

Tax reform may provide some relief for the labor market, according to Vitner. It may encourage younger people to join the workforce and incentivize older employees to remain in the workforce longer, since people are taking home more of their paychecks. However, Vitner noted that any labor market relief from tax reform would not be substantial.

While tax reform may not do much for the tight labor market, Vitner said small business owners are seeing wider profit margins because of it. Being able to expense capital investment expenditures immediately is now a clear incentive for small business owners to reinvest profits into the business to grow, he explained.

Though still a “distant prospect,” Vitner explained that immigration reform could offer great relief to the labor market by allowing many to become fully engaged in the economy.

“I think you have to have the residents know that they are going to be in the United States for the long haul so they can plan on starting a business or buying a home or working toward a major milestone,” Vitner said. “I think immigration will have to be resolved in a way that accomplishes that end, as opposed to it resolving in a way where folks are going to have to be exiting the country.”

If immigration reform does go the way of deportation, Vitner said that wages would be driven up, which may encourage some to enter the workforce. However, he noted that the net labor market would become even tighter, further exacerbating the existing problem. Allowing immigrants to stay would likely increase the number of startup businesses as well, he added.

“The battle over immigration has reduced the interest in immigrating to the United States,” Vitner added. “Legal immigration is still pretty much at its limits, but we need to solve the immigration debate because we have certain parts of the economy that rely on immigrants as workers and the immigration battle has led to a few spot shortages, mostly in construction.”

Since small businesses have so few employees and because owners often wear multiple hats in the operation, reducing regulations is extremely beneficial, according to Vitner. The less time an owner has to spend working to comply with numerous stringent regulations, the more time they can focus on making their business successful and growing, he explained. Currently, some federal regulations have been rolled back, but state regulations continue to be problematic in some states, including California, he pointed out.

At the federal level, Vitner said there has been some relaxing of developmental and environmental regulations as well as reworked definitions of FLSA (Fair Labor Standards Act) exempt and nonexempt workers, which have all benefited small businesses. However, for some states, including California, increasing minimum wages could soon cause serious issues for small business owners. Vitner said that many small businesses, particularly new startups, may not have profit margins to support mandated employee pay increases.

For those looking to start their own business, higher minimum wage is essentially a higher barrier to entry because it increases startup costs, Vitner said. He added that similar regulations such as paid time off and mandatory sick time have the same effect, leading to more part-time labor and less full-time employment.

“There’s always the battle of the way we want things to be and the way that they are. But the one thing that we can always count on in the U.S. is we have a healthy and diverse economy and it is going to grow. We think that we will probably grow 2.5% per year, nationally, over the next five years,” Vitner said. “And the economy doesn’t just grow, it’s constantly changing and evolving, creating opportunities. I think that we’re going to see a really great time to own a small business.”