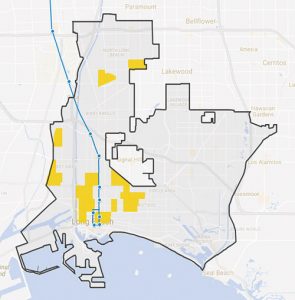

The federal government has created a major incentive for investing in low-income communities in the United States: the Qualified Opportunity Zone (QOZ) program. This program allows investors to postpone and exempt federal taxes on capital gains by investing in property and businesses in federal census tracts designated as opportunity zones. Nineteen such zones exist in the City of Long Beach, areas where new development could yield significant benefits for both investors and residents.

John Molina, a partner in Long Beach investment firm Pacific6, told the Business Journal that opportunity zones are an innovative approach to urban renewal. “Our economy doesn’t work unless everyone can participate in a meaningful way,” he said. “This gets investments into those areas and those communities that have lagged behind.” Pacific6 is currently seeking QOZ projects to invest in throughout Long Beach and Los Angeles County.

Created by the 2017 Tax Cut and Jobs Act, the QOZ program enables individuals, corporations or trusts to place realized capital gains into a Qualified Opportunity Fund, after which they have 180 days to invest in assets located within an opportunity zone. Qualified investments include upgrading existing infrastructure, building new structures, investing in a local business or helping to grow one from scratch. Under the program’s rules, federal taxes on capital gains that are invested in a Qualified Opportunity Fund may be deferred until December 31, 2026. The federal gains tax is reduced by 10% after five years and by another 5% after seven years.

After an investment is held in a fund for 10 years, federal taxes are no longer applied to the capital gains. “The more you keep in the fund for that 10-year period, the higher your return is,” Chris Bucka, director of community investment for real estate firm CalTerra Partners, told the Business Journal. “After that 10-year period, you have a cash-flowing property where, for years on end, you don’t have to pay [federal] taxes on it.”

Bucka is the co-founder of a managing company called CTP Investments, which has committed $5 million to its Qualified Opportunity Fund, the Yellow Brick Road Fund. With a stated target of $25 million to invest, Bucka said that the company is looking for projects in zones located in Los Angeles, Orange County, Riverside and mid-town Long Beach.

California Gov. Gavin Newsom has stated that he wants to oversee the construction of 3.5 million new homes by 2025, which Bucka viewed as encouraging for future development. “The corridor in Long Beach up the Blue Line and pretty much all the way up to Downtown L.A., there’s going to be a major halo effect going on for building,” he said.

Long Beach Deputy Director of Economic Development Sergio Ramirez said that the city is actively promoting its opportunity zones. Ramirez’s department has created an online mapping application illustrating the zones’ locations and where they overlap with areas where expedited land entitlements are allowed. “We really want to let developers know, you can come here and build four or five story residential [buildings], whether it’s affordable housing or market rate housing, and get through the entitlement process between nine and 12 months,” he said.

Brandon Carrillo, a principal at commercial real estate firm Lee & Associates, said that many of his clients, even those who have not traditionally invested in property, are intrigued by the tax relief offered by opportunity zones. “I think it’s a great opportunity, no pun intended,” he said. “If you want to take some chips off the table and cash out your stocks, this is a great way to lower your tax basis and invest in real estate.”

Blake Christian, a partner at accounting firm Holthouse Carlin & Van Trigt, called the QOZ program “the most powerful federal tax tool I’ve ever seen.” He qualified that assessment by noting that the federal government has yet to issue a full set of regulations for the program, despite it being created in 2017. “There’s a lot of layers to the program, and there’s still a number of very important tax issues that we don’t know the answers to,” he said. Related regulations may arrive in March, he estimated.

Despite the wait, Christian still recommended that clients with large capital gains consider investing them into Qualified Opportunity Funds. “We can sit on that money and digest the regulations in a couple months, if they come out that late,” he said. For the moment, there is no penalty for removing money from a fund, and the tax deferral is worth the initial investment, Christian said.

Christian offered another caveat for California investors. At present, capital gains in opportunity zones are still subject to state taxes. This is not the case in every state, Christian explained, as it is up to each state government to decide how to align its own tax compliance with the federal QOZ program. In California, higher income taxpayers can expect a 23.8% federal tax rate on their capital gains, as well as a 13.3% state tax – the highest in the United States. Under current California law, investors in Qualified Opportunity Funds may still defer, reduce and, if held for the long term, exempt their federal taxes, but state taxes are not able to be deferred or eliminated.

In his January budget proposal, Newsom wrote that his administration would like to make economic development tools like opportunity zones “more attractive” for investors. To do this, Newsom proposed bringing California into alignment with the federal program by deferring and reducing taxes for QOZ investments in “green technology or in affordable housing” and by eliminating taxes on those investments held for 10 years or more. Christian told the Business Journal that a Sacramento source involved in the effort to update California’s QOZ program said they expect “some partial conformity within the next couple of months.” Chris Bucka said that he has heard similar news from the state treasury department.

Molina was strongly in favor of bringing California into conformity with the federal program. “Frankly, the long-term benefit of getting people employed and getting people into lower-cost housing . . . far exceeds the tax benefit that the state’s going to get by collecting these taxes,” he said.

Unlike enterprise zones, created under a previous government program that granted tax credits to employers for hiring community members or purchasing assets used within the zone, opportunity zones are directly tied to the improvement of an area, Christian explained. Opportunity zones are not a tax credit, but create equity that appreciates based on the performance of a business or property. Therefore, the more improvement a neighborhood experiences, the more return on investment.

As Molina put it, “I can invest through opportunity funds and get a bigger, better return with a lot better benefit to the neighborhoods and the people living in Long Beach, or I could pay it in taxes. Not a difficult choice for me.”