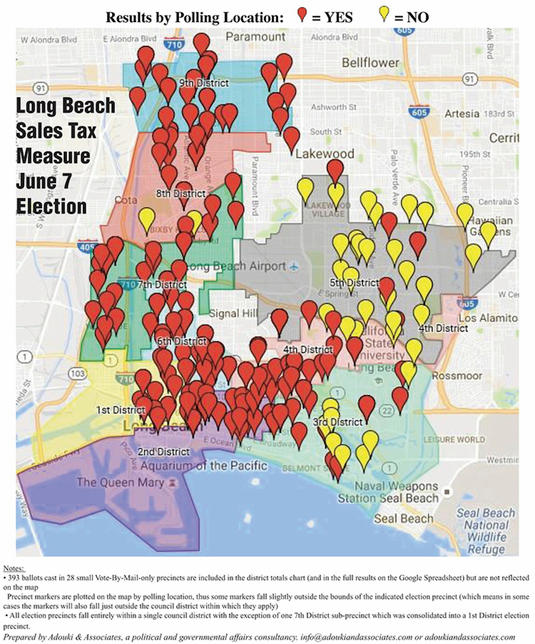

A map by a local consulting firm plotting the final results of the June 7 Long Beach sales tax measure shows that most of the opposition to the tax increase came from residents living in Northeast Long Beach, with heavy opposition from the Los Altos area, Naples and other parts of East Long Beach.

On January 1, 2017, the city’s sales tax moves to 10% from the current 9% – an 11.1% tax increase. The new revenue is to be used for the city’s public safety and infrastructure needs.

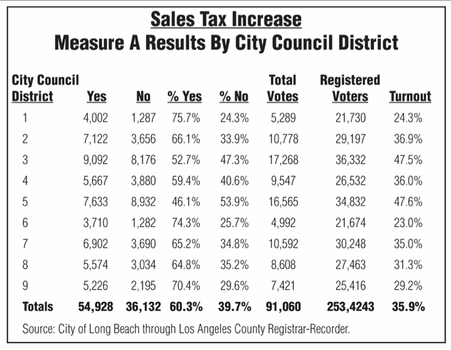

While the measure passed easily citywide – 60% to 40% – a distinct line seems to have been drawn in the city, according to the mapping completed by Adouki & Associates, a political and governmental affairs consultancy firm based in Signal Hill. Of the 43 precincts in the city opposing the measure, 41 are located east of Lakewood Boulevard (the other two are in the Virginia Country Club/Bixby Knolls area).

(Click to download this image as a PDF)

The 5th City Council District is the only district where the measure failed, with 54% of voters in opposition (refer to adjacent chart). The entire 90808 zip code is within the 5th District, as is part of the 90815 zip code. The two zip codes represent the lowest crime rates in the city and encounter far fewer infrastructure problems compared to other areas of Long Beach – factors that may have played into why voters were against the tax increase.

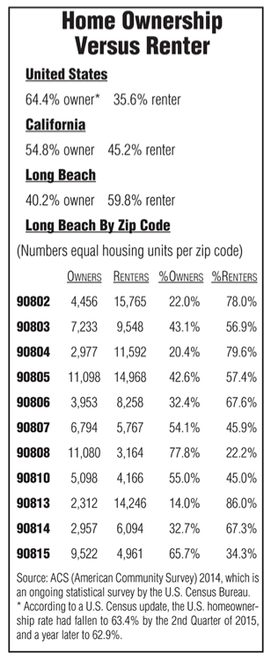

Home ownership may have also played a role in the vote. For example, the same two zip codes account for the highest home ownership rates in the city – 77.8% in the 90808 zip code and 65.7% in 90815. Citywide, home ownership is one of the lowest in the country at barely over 40% (U.S. home ownership is at 64.4% and 54.8% in California). Homeowners are paying increased property taxes that renters are not concerned about, including the passage of the Long Beach City College bond measure on the same June 7 ballot, and the most likely passage of a Long Beach Unified School District bond measure on the November 8 ballot.

Two other interesting tidbits that may have impacted the vote: (1) a majority of the city’s registered Republicans – who historically lean anti-tax – live in East Long Beach (as of June 1, 18.8% of voters are registered Republicans and 51.9% are Democrats); and (2) Mayor Robert Garcia led the effort to pass the tax. When he was elected in 2014, the only city council district he lost was the 5th, and he won the 3rd District by fewer than 50 votes.

Surprisingly, the highest support for the tax increase – 70% plus – came from the three city council districts with the most people at or below the poverty rate – the 1st, 6th and 9th Districts.

That is a puzzling since an argument made by tax opponents was that lower-income people could least afford the increase – which, as pointed out previously, amounts to an 11.1% tax hike. In fact, the tax increase negates the January 1, 2016, state increase in the minimum wage, which went from $9 an hour to $10 an hour, or, that’s right, 11.1%. Additionally, it is generally accepted that sales taxes are regressive because the cost of essentials such as food, rent and clothing make up a higher percentage of a lower-income worker’s budget.

Therefore, one must wonder if many voters did not fully understand the tax increase or the impact on their pocket book, or maybe they were swayed by the massive campaign – mailer after mailer – to pass the increase. However, the opposite may also be true: voters clearly understood what they were voting on, and their voice came through loud and clear that they trust the mayor and city councilmembers to hire more police officers to fight rising crime and to address the city’s infrastructure needs.

According to Adouki & Associates, the city’s police union poured more than $213,000 into the Measure A Yes campaign. Other large donations came from the city’s firefighters’ union, which gave $77,625, and more than $130,000 was donated from three other union groups.

The consulting company claimed voters were “vulnerable to the influence of false and misleading mailers,” including one that said voting yes would result in more police and firefighters, with big bold numbers stating “200 fewer cops, 80 fewer firefighters = a less Safe Long Beach.” The inference, the company says, is that passing the tax would result in all those public safety positions being filled, which is unlikely.

In a statement, Adouki & Associates called the campaign “one of the most dishonest in Long Beach political history – $600,000-plus spent to ‘educate’ voters about what they were voting for without ever using the words ‘sales’ or ‘tax’ to describe a referendum on a new sales tax.”

Whether one agrees with the consulting firm or not, the fact is the tax passed. Now the onus is on the mayor and councilmembers to keep their word.

City officials often talk about Long Beach being one big, beautiful city, full of diversity. That may be true, but politically there is a line and the vote on the sales tax measure clearly pointed it out.