Following the passage of Measure W in November 2018, Los Angeles County residents and property owners must pay a new parcel tax beginning in 2020. This parcel tax, levied at $0.025 per square foot of impermeable land, is intended to fund the Safe Clean Water (SCW) Program which is designed to capture billions of gallons of stormwater that drains to the ocean every year.

The program makes a long-term investment in water sustainability, but the lack of a termination date for the new tax and its vague means of implementation have left some members of the business community troubled.

Peter Herzog, assistant director of legislative affairs for the National Association of Industrial and Office Properties (NAIOP), a commercial real estate organization, was on the steering committee for Measure W before it was put on the ballot. Herzog told the Business Journal that NAIOP worked with the county to develop a plan for reclaiming water that included specific goals, costs and a deadline. “We’re sort of inundated with taxes and fees already, so we weren’t thrilled about a new parcel tax,” Herzog said of the real estate sector. “But we went in with the idea that obviously everyone wants to improve the stormwater issue.”

Herzog pointed to the previous Measure R, a sales tax to fund transportation projects, as a good example of what he had hoped to accomplish. Measure R contained an expenditure plan that identified projects to be funded and additional fund sources that would be used to complete those projects. To Herzog’s disappointment, the final version of Measure W was much more open-ended.

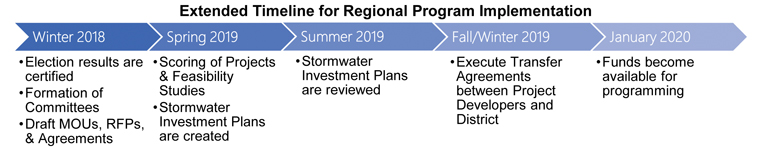

Revenues from the new tax will cover the costs of projects and programs meant to increase stormwater capture. Such projects and programs have been identified in the county’s Enhanced Watershed Management Program, the Los Angeles Basin Stormwater Conservation Study and the Los Angeles Department of Water & Power’s Stormwater Capture Master Plan, with further feasibility studies to be created later this year. The first transfer agreements between project developers and the flood control district are set to be executed in fall and winter 2019.

After a period of 30 years, the SCW program report states, the L.A. County Board of Supervisors “shall evaluate the need for the SCW program and make a determination of whether the tax should be reduced or rescinded.” De’Andre Valencia, advocacy director at the Los Angeles County Business Federation (BizFed), has reservations about the tax ever coming to an end. “It’s a forever tax,” he said. “We were asking the county at some point to review the tax and . . . just let it cover ongoing maintenance and operations.” Unsuccessful at that attempt, Valencia said BizFed is now resolved to make sure the implementation process of SCW is transparent.

Later this year, the board of supervisors will convene to create an ordinance outlining how the tax will be implemented. There have been estimates made for how much property owners may be expected to pay, but until the new ordinance is released to the public, nothing is certain. “Two months after the election, [we] still don’t know what it’ll do,” Herzog said. “It’s totally unclear how much we’ll even get taxed.”

When the parcel tax is collected next year, it will be included with each parcel’s annual property tax bill. Ten percent of the tax revenue is to be used to offset the county’s related administration costs, 40% is to be used for municipal projects and programs, and 50% is to be used for regional projects and programs.

Credits And Exemptions

L.A. County Department of Public Works (LACDPW) told the Business Journal that the parcel tax will be applied to “impermeable” constructed surfaces on private properties, which may include buildings, sidewalks, driveways, asphalt, concrete, awnings and pools. The county calculates the amount of impermeable surface on properties based on its latest landcover survey, which pulls from several data sources including multi-band aerial imagery, object-based image analysis, photographs and laser imaging.

Property owners that believe their tax has been calculated incorrectly will have the chance to appeal if there is a discrepancy of at least 10% in impermeable area, or $50 in the tax amount, whichever is greater.

According to the LACDPW, qualifying low-income seniors would be exempt from the parcel tax, though they must first apply for exemption. The department further clarified that this application is currently under development. Other exempt parcels include properties already exempted from ad valorem property taxes, such as qualifying nonprofits, schools and government buildings.

The final SCW program report states that the board of supervisors shall adopt an ordinance no later than August 1, 2019, to establish procedures and criteria for a tax credit program. This program would allow up to 75% credit for parcel owners that perform stormwater and/or urban runoff improvements that result in “water quality benefit.”

Amber Ballrot, an environmental compliance specialist with WGR Southwest, told the Business Journal that she is pleased the LACDPW eventually modified the tax credit program to include holders of National Pollutant Discharge Elimination System (NPDES) permits, which regulate the discharging of pollutants into bodies of water. WGR Southwest is an environmental, health and safety consulting firm with business clients in the county who will be affected by the tax.

Those facilities in compliance with NPDES rules can achieve up to 80% tax credits, Ballrot said. But to achieve a full 100% credit, parcel owners must perform qualifying additional activities “to be determined and approved by the county flood control district.” For most of her clients, Ballrot said, the remaining 20% of SCW tax might not be a substantial amount of money, but larger landholders may still pay a considerable amount.

Ballrot said she is currently working with the county’s public works department to determine how the tax is applied to sites that collect water runoff and send it to treatment centers. “I expect there will be other site-specific circumstances that this tax program did not account for,” she said.

When the Business Journal asked LACDPW how this type of collection might impact the tax owed, the department emphasized that the tax is calculated based on impermeable surfaces. “Some parcels might either keep runoff from leaving the site or route runoff to a designated location or system, but this is not factored in the tax amount,” Steven Frasher, community engagement liaison for LACDPW, said. “It is based purely on square footage of impermeable surface.”

Without accounting for tax credits, the county projects that gross revenues from the parcel tax could total approximately $300 million per year for the Los Angeles region. It estimates the median cost to a residential property owner would be $83 per year. For residents of multi-family units, there are currently no provisions in the SCW tax that limit a parcel owner’s ability to passthrough the proposed tax to a tenant.