This National Small Business Week (April 30 through May 6), small business owners in the United States have a lot to be optimistic about. The latest Wells Fargo/Gallup Small Business Index report found that optimism among small business owners was at its highest point since the start of the Great Recession.

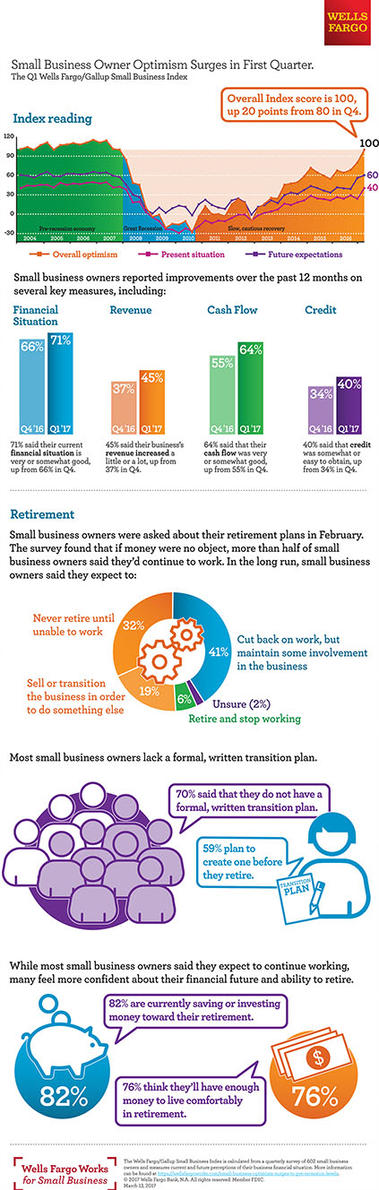

In February, the overall index score – formulated by scoring the results of a 12-question survey – was at 100. In 2016, the first three quarterly index reports ranged from scores of 64 to 68 until the score jumped to 80 in November.

Ben Alvarado, president of Wells Fargo’s Southern California region, joins California State University, Long Beach President Jane Close Conoley at his alma mater. Wells Fargo sponsors the university’s athletics department and provides financial literacy resources to students through its on campus branch. (Business Journal photograph by Evan Patrick Kelly)

The highest level of optimism was a score of 114 in the fourth quarter of 2006, and the lowest was a reading of -28 in the third quarter of 2010, according to Wells Fargo. Possible index scores range from -400 to +400.

The Small Business Index score has not reached 100 since July 2007.

“It’s a really good representation of what I see and hear from our business customers as I am out in the market or in the branches,” Ben Alvarado, president of Wells Fargo’s Southern California region operations, told the Business Journal. “In short, business customers are definitely feeling more optimistic about where they are at right now and, I think, where they see the future.”

Seven out of 10 small business owners surveyed for the index reported that their current financial situations were “very or somewhat good,” a 5% increase since November, according to the report. Forty-five percent of those surveyed reported that their revenues had increased “a little or a lot” in the past year, an increase of 37% since November.

About 64% of small business owners said their cash flow was somewhat or very good in the past year, an increase of 55% since November. And 40% reported that credit was “somewhat easy to obtain” in the past year, which represents a 34% increase in owners who said the same in November.

“I think there are a variety of things that are going on, but what I hear most from customers and also from business leaders in the community has a lot to do with the current administration and what people are hearing and seeing in relation to potential impact to regulations which may make it easier to do business for some folks,” Alvarado said.

While no one Alvarado has spoken to has cited a specific policy reform as cause for optimism, he said the general anticipation that tax laws and regulations will change for the better is encouraging many business owners.

Ben Alvarado, president of Wells Fargo’s Southern California region, pays a visit to the Wells Fargo museum in Downtown Los Angeles. He is pictured with an original Concord stagecoach, which the bank used in the mid-1800s to traverse thousands of miles from California to Nebraska and Arizona to Idaho, according to the museum’s website. (Photograph by the Business Journal’s Larry Duncan)

Although he “couldn’t say for sure,” Alvarado noted that the timing seems to indicate that the 12-point jump in small business optimism in November had something to do with the results of the presidential election. “From everything I am reading or seeing in the news, as well as talking to our economists . . . and some external economists [who] speak to it locally in the community, that definitely has been something that people feel is driving that optimism,” he said.

Wells Fargo is experiencing increased interest from small business owners in their products, particularly credit options. “There is an increased awareness and an increased interest in folks talking about products that may help with their growth or expansion or even for startup businesses too,” Alvarado observed.

In particular, he is seeing increased interested in Fast Flex, “a simplified way of getting credit with limited paperwork . . . based more heavily on the individual’s credit score,” Alvarado noted.

The report by Wells Fargo and Gallup also found that 73% of business owners expect “to either cut back on work but always maintain some involvement in the business, or never retire until they are unable to work.”

Alvarado said he was not surprised by this statistic. “It’s very common with a lot of small business owners. It is part of who they are,” he said. “So it’s hard for a lot of small business owners to see anyone else ever running their business and taking care of it like they would.”

About 70% of small business owners indicated that they do not have a formal succession plan for their businesses in the event they retire or stop working. More than half of survey respondents said creating a succession plan was not a priority at the time.

“I don’t think it’s ever too early to think about it,” Alvarado said of retirement and business succession planning. “And that’s one thing about small business owners, they are so committed to what they do and building a business that they are often not thinking about retirement,” he said. “But you do get to some point that you don’t want it to get to be too late before you start planning for succession, maybe passing it on to the next generation in your family, or even selling it to someone else. . . . It’s better to have a plan and change your plan than to have no plan at all.”

WellsFargoWorks.com, a free resource for small businesses (whether they bank with Wells Fargo or not), offers tools for business planning, Alvarado noted.

While most respondents did not have a solid business succession plan, 82% of them said they were saving or investing toward retirement, with 76% reporting that they think they will have enough money to live comfortably in retirement.

The index also pointed out that there were fewer small business owners with concerns about financial matters related to retirement.