The overall economic outlook for the United States’ economy in 2017 is positive, with economists projecting a higher rate of growth for gross domestic product (GDP) and continued job gains, according to regional and national economists.

Some of President-elect Donald Trump’s proposals could benefit individuals and companies, such as personal income and corporate tax cuts. On the other hand, it is still unclear whether some of the major policies Trump campaigned on – mainly repealing the Affordable Care Act and potential changes in trade policy – will have positive or negative impacts on the economy.

Total Terminals International, pictured at Pier T within the Port of Long Beach, has undergone challenges this year due to the bankruptcy of its majority stakeholder, Hanjin Shipping. Mediterranean Shipping Company, which previously held minority ownership of the terminal, is expected to take on full ownership, which will bring back lost cargo volumes to the port. (Photograph by the Business Journal’s Larry Duncan)

Wells Fargo Senior Economist and Managing Director Mark Vitner said he is anticipating GDP to increase by 2.3% this year. Figures for 2016 are not in yet, but he expects last year’s growth rate to come in around 1.6%.

Steven Cochrane, managing director of Moody’s Analytics, said he expects GDP to increase by about 2.8% in 2017. He has readjusted his outlook for GDP growth in 2018 following the outcome of the presidential election, he noted. “We thought that 2018 might look like about 2.7% – that was our forecast in October. And now we are looking something closer to about 3% in 2018,” he said.

In 2016, the U.S. added jobs at a rate of about 180,000 per month, although in the last three months of the year the pace slowed to about 165,000 jobs per month, according to Vitner. “We are looking to add about 160,000 jobs a month in 2017, which is still more than enough to pull the unemployment rate down,” he said.

The national unemployment rate is 4.7%. While full employment has historically been considered to be 4.5% to 5%, Vitner said that might no longer be the case. Many workers today do not consider themselves fully employed because they are working part time, he explained.

In November, the seasonally adjusted unemployment rate in California was 5.3%, according to Robert Kleinhenz, an economist and executive director of research for Los Angeles-based Beacon Economics. Seasonally adjusted figures account for seasonal trends in labor markets, such as holiday hiring. California’s unemployment rate rarely drops below 5%, he noted.

“In Long Beach, which is not a seasonally adjusted number, the unemployment rate for November was also 5.3%, down from 6.4% a year earlier,” Kleinhenz said. “The labor force in the City of Long Beach grew by 2.1% year to year,” he continued, adding that Long Beach ought to experience substantial growth in job counts this year.

The largest job gains locally should continue to be concentrated in the health care, leisure and hospitality, professional and logistics industries, according to Kleinhenz.

Kleinhenz is still projecting job growth in the health care sector because he does not believe a repeal or rollback of the Affordable Care Act (ACA) will go into effect this year.

Vitner has a similar expectation in regards to the ACA. “I am optimistic that the Republicans . . . are going to repeal it in a way that maintains coverage so that nobody is scrambling to find coverage and hospitals are not inundated with the folks who thought they had coverage and no longer do,” he said.

On January 12, the Republican-majority U.S. Senate approved a resolution establishing a budget blueprint to repeal the ACA. The following day, the House of Representatives approved it as well.

“It creates a lot of uncertainty for a sector in the economy that has generated a fair amount of growth over the last two years, and that is health care and financial services,” Cochrane said of Republicans’ moves to repeal the ACA.

Trump has stated that he wants to institute tariffs to address the imbalance of trade, as the U.S. accepts far more imported goods than what it exports. He has also argued that trade agreements like the North American Free Trade Agreement (NAFTA) have caused American manufacturing jobs to be outsourced and has indicated he wants to throw out such agreements or renegotiate them.

Some trade policies only require executive authority, so it is possible changes may be made within weeks, Cochrane pointed out. Kleinhenz, however, said he would be surprised to see any changes this year.

Tariffs could result in negative economic impacts at home. “In the near term, one of the first effects from tariffs will be to raise prices for many consumer goods, which means that we could see an acceleration of inflation,” Cochrane said. “And that in turn then means households will have less money in their pockets to spend.”

“I would hope that the sort of aggressive trade policies that President-elect Trump spoke about will not materialize in 2017 or during his administration,” Kleinhenz said. “I understand that he wants to level the playing field, but one of the reasons . . . is that he thinks that a lot of jobs left the United States to go elsewhere – and mainly manufacturing jobs. But the research shows that most of the displaced jobs in manufacturing were lost to technology, not to movement of jobs overseas.”

Still, Kleinhenz said he expects trade through the San Pedro Bay ports to increase this year, in part due to anticipated increased consumer spending. However, the rising value of the dollar against international currencies is likely to hurt U.S. exports to a degree.

Tax cuts are likely to take place quickly this year, Vitner said. Cochrane estimated that there are going to be $10 trillion in tax cuts spread out over the next 10 years. “About two-thirds of those tax cuts will be personal income tax cuts, and then one-third will be corporate tax cuts,” he said. “That is a very positive impact on the economy in 2018 and early 2019 as disposable income rises, and that income can be spent by consumers or spent or invested by businesses.”

A reduction in taxes, however, means an increase in the national debt, which could result in a pullback on tax cuts or on the major infrastructure spending expected under the new administration, according to Cochrane.

Regionally, both residential and commercial real estate markets are expected to do well, based on Kleinhenz’s forecasting. Despite rising interest rates, homes should remain in high demand for purchase in Long Beach, and home values are expected to continue appreciating.

The South Bay office market experienced about a 2% reduction in vacancy in 2016, and vacancy should continue to decline this year, according to Kleinhenz. Industrial real estate will remain in short supply and high demand, which will continue driving up rents and sales prices.

The financial industry is also expected to fare well this year. “The financial sector seems to be doing better,” Vitner said. “Loan growth has picked up. Certainly the tax sector is doing well in Southern California.”

Vitner added that he hopes the regulatory relief under the new presidential administration will stymie the trend of small bank consolidation. “Community banks performed a vital role of providing seed capital to new businesses that would be unable to borrow from a larger financial institution. And if we lose the community banks, I think we lose a critical element of our financial system,” he explained.

The oil industry is expected to continue to contend with oil prices around the $50 mark, Kleinhenz said. “That is an industry that has struggled for almost three years when the price of oil plunged,” he said, referring specifically to Long Beach’s oil industry.

The manufacturing industry in Los Angeles County is expected to sustain more job losses due to workers being displaced by technology, according to Kleinhenz. Vitner attributed area manufacturing job losses to state regulations. “Manufacturing is in a tough spot in Southern California because of the rising cost of doing business, increases in the minimum wage and competition from lower cost areas like Arizona or Texas or Nevada,” he said.

This year, the state minimum wage is increasing from $10 to $10.50 per hour. “It may be difficult to measure early on, but I do think there will be some job losses or job hiring that does not take place with the higher minimum wage,” Kleinhenz said.

Although there is a significant degree of uncertainty in respect to the potential impacts of new policies under a Trump presidency, Kleinhenz said he expects the economy to continue improving as it has for the past few years. “I don’t see things changing dramatically anytime soon,” he said. “And no recession.”

International Trade

San Pedro Bay Ports Outlook Stable Despite Shipping

Industry Realignment And Impending New Trade Policies

By Samantha Mehlinger, Assistant Editor

Despite fluctuations in the global shipping industry and the potential for new trade policies as President-elect Donald Trump takes office, both San Pedro Bay ports have stable outlooks for cargo growth in 2017.

The Port of Los Angeles (POLA) broke the record for the most cargo ever flowing through a port in the Western Hemisphere in 2016, having handled 8.8 million twenty-foot equivalent units (TEUs) of cargo. This year, the port should experience cargo growth in the low single-digit percentage range, according to Michael DiBernardo, POLA’s deputy executive director of marketing and customer relations.

In 2016, the Port of Los Angeles broke the record for the most cargo volume passing through a port in the Western hemisphere. The port handled 8.8 million twenty-foot equivalent units of cargo last year, an overall cargo volume increase of 8.5%. (Photograph by the Business Journal’s Larry Duncan)

The Port of Long Beach (POLB) experienced a 5.8% decline in overall cargo volumes in 2016, handling 6.8 million TEUs. Port officials attributed the decline to the bankruptcy of Hanjin Shipping, a Korean shipping line that owned a majority stake in the POLB’s largest terminal, Total Terminals International (TTI). Still, it was the fifth-best year ever for the port.

“Obviously, 2016 was a challenging year for the Port of Long Beach, with cargo lost and particularly with the unexpected Hanjin bankruptcy,” Duane Kenagy, interim executive director, told the Business Journal. “We believe we’re through the worst of that and have a path forward. Our expectations are that 2017 is going to look much better.” Nationally, Kenagy said he expects trade to increase 2% to 3%.

The Long Beach Board of Harbor Commissioners recently approved Mediterranean Shipping Company’s bid to take over the majority stake in TTI, of which it previously had minority ownership. The company’s subsidiary, Terminal Investment Limited (TIL), will operate the terminal. The shipping line is the second largest in the world and is part of a new shipping alliance with Maersk called the 2M Alliance.

On April 1, a reshuffling of the world’s shipping alliances will go into effect, consolidating four major alliances into three. “The alliances are going to be an uncertainty as they start finalizing where ships are going to be calling in San Pedro Bay,” DiBernardo said. “Traditionally, you would think that a company that owns the terminal would run the volume through that terminal, but with these alliances that may change.”

Shipping companies have been struggling with a dynamic of overcapacity and weaker-than-expected demand for goods across the world. As a result, the rates they charge to ship those goods have plummeted. “We’re certainly hoping that the industry consolidation that has occurred is a positive for us and that rates stabilize and that the industry becomes a little healthier in 2017 than it was in 2016,” Kenagy said.

Construction on the replacement for the Gerald Desmond Bridge continues at the Port of Long Beach. When completed, its roadway will be about as high as the top of the arch on the current bridge – about 200 feet. According to port spokesman Lee Peterson, the two towers that will support the cable stayed span of the new bridge will each be 515 feet high. The clearance over the water for the current bridge is 155 feet. For the new bridge it will be about 205 feet, allowing larger vessels to pass beneath it in to the inner harbor. The new bridge will also feature more lanes for traffic. (Photograph by the Business Journal’s Larry Duncan)

Positive changes may be on their way for the local trucking industry thanks to efforts by the ports and supply chain stakeholders. “I think in the trucking industry there is going to be a little bit more involvement in turn times,” DiBernardo said, referring to the time it takes a truck to enter a terminal, return or pick up cargo, and exit the terminal. Terminals and trucking firms have contracted with a company that uses GPS to monitor truck turn times, he said. That information will be used to track patterns and, in theory, improve turn times at individual terminals.

DiBernardo speculated that terminals are likely to create appointment systems for truckers to improve turn times. Additionally, PierPass, which establishes peak and off-peak shifts and corresponding entry rates at the terminals, may also see changes this year. “We think there is going to be a PierPass update in 2017 which is . . . hopefully going to improve efficiencies,” DiBernardo said.

Officials from both San Pedro Bay ports are keeping a close eye on the new presidential administration. “We’re reaching out to the transition team members,” Kenagy said. “We’re back in Washington regularly making sure that the message of the Port of Long Beach is heard and understood.”

DiBernardo said the Port of Los Angeles is making the same efforts. “We are going to stay close to these folks, understand what they are looking at and tell them how important the San Pedro Bay port complex is to the local economy, the nation’s economy, as well as the workforce here in Southern California,” he said. Phillip Sanfield, director of media relations for the POLA, said the port complex supports 954,000 jobs in the Southern California five-county region.

Both DiBernardo and Kenagy pointed out that the incoming administration has indicated an interest in investing in transportation infrastructure, which could benefit the ports.

Both ports continue to improve their facilities with major capital improvement projects. The Port of Long Beach’s Middle Harbor Redevelopment Project, which is combining two aging terminals into a state-of-the-art facility able to handle the world’s largest ships, is continuing on schedule, according to Kenagy. The project’s first phase opened last year.

The Gerald Desmond Bridge Replacement Project is visibly progressing, with bases of the two towers for the new bridge now higher than the existing Gerald Desmond Bridge. “The towers should top out later this year, and [we will] begin construction of the cable-stayed main span structures,” Kenagy said. The project is scheduled for completion in 2019.

“We have a number of other smaller capital projects that will progress this year,” Kenagy said. “We are in a formal release of the draft environmental impact report (EIR) document for our Pier B on-dock rail support facility.” The project will allow containers to be placed directly onto trains from ships, thereby reducing truck trips and air emissions. A second public hearing on the draft environmental impact study for the project is being held at 6 p.m. tomorrow, January 18, at the port’s offices, 4801 Airport Plaza Dr.

Dock improvements to allow larger ships to berth at Pier G are also slated for this year, according to Kenagy.

At the Port of Los Angeles, a $510 million improvement project at the TraPac Terminal is nearing completion. Improvements include extending wharves, deepening water depth at berths, installing new cranes and more. New automated on-dock rail at the terminal is now undergoing testing by TraPac, according to DiBernardo. Once the project is complete, every terminal at the POLA will have on-dock rail. Another ongoing terminal project involves deepening the water at Yusen Terminal to allow for larger ships to berth, he noted.

The Middle Harbor Redevelopment Project continues at the Port of Long Beach. The massive project combines two aging terminals into a state of the art facility with zero-emission, automated equipment capable of handling the world’s largest vessels. The operator of the facility, which is partially operational during construction, is Long Beach Container Terminal, a division of Orient Overseas Carrier Line. (Photograph by the Business Journal’s Larry Duncan)

The POLA is also realigning Harbor Boulevard at 7th Street and Sampson Way as part of the redevelopment of Ports O’ Call Village into the San Pedro Public Market. That project is still in the design phase by developer LA Waterfront Alliance.

Environmental impact reports for proposed improvements at Everport, China Shipping and Yang Ming facilities are also underway, DiBernardo said.

The POLA is continuing its pilot project with General Electric, in which data about incoming ships is shared among shipping lines and terminal operators to ensure better flow of goods upon arrival. Sanfield said if the project is successful, the technology has the potential to benefit many other aspects of the supply chain, including trucking companies, chassis owners, the International Longshore and Warehouse Union, and cargo owners.

The ports are working together to update their Clean Air Action Plan this year. The plan was adopted in 2006 and has resulted in major reductions in air emissions that are harmful to health and the environment. The ports are holding a workshop on the new draft of the document on Tuesday, January 24, from 6 to 8 p.m. at Banning’s Landing Community Center, 100 E. Water St. in Wilmington. The review period for the document, which is available at www.cleanairactionplan.org, ends February 17.

For the Port of Long Beach, one of the most important efforts this year is that of the Long Beach Board of Harbor Commissioners to find a new chief executive. Its former CEO, Jon Slangerup, left the port in the fall to lead a major aviation firm in Canada. Kenagy said he expects the harbor commission to find a replacement by April. “They’re committed to doing a robust and thorough search to get the best executive available for that key position,” he said.

Health Care

Industry Outlook In Question As Likely Repeal Of Affordable Care Act Looms

By Samantha Mehlinger, Assistant Editor

Uncertainty reigns in the health care industry as a Republican-led Congress and new presidential administration gear up to repeal the Affordable Care Act. Local hospitals and health care providers are moving forward with planned expansions and investments but beyond that are taking a wait-and-see approach before developing any new major plans.

Long Beach-based Molina Healthcare has undergone rapid growth since the implementation of the ACA. The firm is a provider of Medicaid, Medicare and other health plans, and it also operates health clinics and provides health information management services to state governments.

Miller Children’s & Women’s Hospital Long Beach staff gather for a meeting within the hospital’s new pediatric intensive care unit. (Photograph by the Business Journal’s Larry Duncan)

“Between our full-time employees, part-time employees and contracted staff here at Molina, we have about 9,000 people working in Long Beach,” Chief Financial Officer John Molina told the Business Journal. “That shows you how much we have grown over the past few years.”

Molina is unsure if that growth will continue. “I can’t say we will continue to grow because we don’t know what the new administration is going to do with the Affordable Care Act,” he said. “But I think one of the hallmarks of our company is we have always remained nimble and flexible.”

This year, Molina Healthcare is putting more of an emphasis on improving profit margins. “For the last five years, we have been growing so fast that a lot of our excess profits have been reinvested in continuing to build the infrastructure,” Molina noted.”

In terms of offering new programs and services, Molina Healthcare is “in a wait-and-see mode,” according to Molina. But the firm is moving forward with opening two clinics in the region, including one on Atlantic Avenue in Long Beach’s 6th District, as well as one on the campus of Compton Junior College. Both are opening in the first quarter of the year.

Molina speculated that although it doesn’t seem Republicans yet have a replacement plan for the ACA, they are unlikely to turn the clock back to 2006 when about 20 million fewer Americans were uninsured. “The fact is that over 20 million people have gotten health care coverage through various parts of the Affordable Care Act. If you were to somehow magically wipe the slate clean, those 20 million people don’t go away,” Molina said.

The outlook for Molina Healthcare depends upon how the replacement of the ACA is structured and how the company adapts, according to Molina. “In fairness to some of the critics of the act, there are an awful lot of regulations and mandates that have made it more costly to provide health insurance,” he said. “So if some of those things can be streamlined and we can provide good coverage . . . for people at a lower cost, I think that’s great.”

Also important to Molina’s future is an upcoming court decision on the legality of the merger of Aetna and Humana. If approved, the companies would have to divest management of 300,000 Medicare Advantage Plan patients, which Molina Healthcare would take on. “We would get into the Medicare Advantage program in a very big way,” Molina said.

John Bishop, CEO of MemorialCare Health System’s three Long Beach hospitals – Memorial Medical Center, Miller Children’s & Women’s Hospital and Community Hospital – said the outlook for the health care industry is uncertain at the moment.

“If it’s repealed, and I do think that is likely, I think it will be replaced with something that is substantially similar,” Bishop said. “I don’t think that they will take away insurance from 20 million people. They will continue to cover preexisting conditions, and they will continue to have incentives to keep people healthy.”

Regardless of what happens with the ACA, Bishop believes the movement toward population health – maintaining the health of a population to reduce health care costs, rather than an illness-centered model of care – will continue. MemorialCare Health System is making investments toward this end within Long Beach, he noted.

Last year, Miller Children’s & Women’s Hospital Long Beach debuted a newly expanded pediatric intensive care unit. Pictured in the state-of-the art facility is patient Angela with Dr. Saar Danon, medical director of pediatric cardiology and congenital cardiac catheterization. (Photograph by the Business Journal’s Larry Duncan)

“We are investing in ambulatory centers and free-standing imaging to try and increase the value and improve the care that is provided in our community,” Bishop said, referring to outpatient walk-in centers off the hospitals’ campuses. In the next few months, Memorial is opening an office with primary care, obstetrical and gynecological services at Douglas Park, he added.

Miller Children’s & Women’s Hospital is moving forward with plans to create a pediatric outpatient village, according to Bishop. The village would house all pediatric outpatient services in one location near the hospital. Children would be able to see multiple physicians and specialists in one visit. “We are anticipating taking that through our internal approval process in March, and then . . . it would take roughly two years,” he said. Last year, the hospital gained a new pediatric intensive care unit, he added.

Recently, Long Beach Memorial Medical Center has received a number of improvements. “We recently installed a hybrid room which enables us to do complex cardiac procedures,” Bishop said. Other additions include a robot that allows the hospital to perform partial and full knee replacements, and the upcoming replacement of the hospital’s cath labs.

Community Hospital’s future is a bit less certain as MemorialCare assesses what can be done with the facility due to seismic challenges at the site, according to Bishop. “We anticipate this spring being able to make an announcement as to the future of that hospital,” he said.

Lakewood Regional Medical Center, which is operated by Tenet Health, and Dignity Health St. Mary Medical Center are both also investing in their cardiology, orthopedic and joint replacement capabilities. In the past year, Lakewood Regional opened a new center for joint replacement, according to hospital CEO John Grah.

“We are showing a real stable kind of business model, and we have seen some good growth in a number of service lines, particularly around cardiology and orthopedics,” Grah said. “If we don’t see huge changes through the Affordable Care Act with the new administration in Washington, we should see ourselves remaining pretty stable.”

In 2016, St. Mary invested in a new magnetic resonance imaging machine and a new cath lab, according to Julie Sprengel, vice president of Dignity Health’s Southern California region. Sprengel has taken on an increased role at St. Mary after former President and CEO Joel Yuhas moved on to pursue another career opportunity in Colorado at the end of the year.

“In 2017, one of the big areas that we’re focusing on is expanding and upgrading our emergency department, as well as developing and advancing our care for seniors,” Sprengel said.

The St. Mary Medical Center Foundation is raising $11 million to fund the emergency room (ER) expansion, with Dignity Health matching those funds. Drew Gagner, president of the foundation, said he expects to raise that amount by the end of 2017. “We are expanding from 26 beds to 47 beds,” Gagner said. Also, “We’re adding a senior emergency room within the emergency room.”

St. Mary has experienced an influx of patients to its emergency room in recent years, as have most hospitals in Southern California, according to Sprengel. She attributed that influx to a lack of primary care physicians in the area.

Long Beach Memorial had a record year for ER visits in 2016, according to Bishop. Lakewood Regional experienced a decrease in ER visits because its ER had been serving as a proxy for that of Martin Luther King, Jr.-Harbor Hospital since it closed in 2007. The new Martin Luther King, Jr. Community Hospital recently opened in its place, thereby reducing patient volume at Lakewood Regional, Grah explained.

Executives from each Long Beach-area hospitals agreed that receiving adequate service reimbursements from insurance companies has been challenging in recent years.

“Reimbursement continues to be a challenge because there are more Mendi-Cal patients, which tend to not cover our costs,” Bishop said. “Revenue is the challenge not just in Long Beach but throughout the industry because what we’re being paid is not increasing as our costs are increasing.” He added, “We have to try to look to reduce costs to the extent that there is no impact on patient care, and we look to grow our profitable product lines and continue to expand strategically.”

As the ACA has had time to mature, more and more patients visiting area hospitals are insured. “We have really kind of created a model where we have covered most Californians with health insurance,” Grah said. “Access to care has really improved for folks dramatically.” Repealing the ACA abruptly, he added, would disrupt these improvements and the health care system overall.

Financial Services

Trump Policies And Business Optimism Drive

Positive Financial Services Outlook For 2017

By Samantha Mehlinger, Assistant Editor

Local financial services industry professionals have a positive outlook for the year ahead as they look toward continued economic growth, financial policy reform and a less stringent regulatory environment under a new presidential administration.

Ben Alvarado, president of Wells Fargo Bank’s Southern California region, cited several positive indicators for the financial industry, as well as for the economy overall. “We are moving into 2017 with much momentum,” he told the Business Journal. “Consumer confidence is at its highest in 13 years, and economists and pundits are predicting less business regulation with the new presidential administration. Many are explaining the stock market surge as a sign of great times ahead in our economy, which will positively impact the banking industry and business across industries,” he explained.

Michael Miller, president and CEO of International City Bank, said he expects 2017 to be a stable year for his bank, with little change from 2016. Industry wide, he expects consolidations and acquisitions of small banks to continue. (Photograph by the Business Journal’s Larry Duncan)

The Wells Fargo Gallup Small Business Index, released in early December, found that surveyed small business owners anticipate a positive year in 2017, with expectations at their highest since 2008, according to Alvarado.

“Forty-five percent of small business owners say they expect the operating environment for their business to be better in 2017,” Alvarado wrote. “The increase in small business optimism was largely driven by business owners’ expectations that their finances will improve in 2017. More than half (58%) expect their business’s revenue to increase a little or a lot in the next 12 months, up from 48% in July.”

He continued, “Seventy percent believe their cash flow will be somewhat or very good in the next 12 months, up from 65% in July. Thirty-five percent say they plan to increase their capital spending a lot or a little, up from 25% in July. . . . With these factors and many others that we are seeing, I am very optimistic that our customers will be thriving in 2017.”

Expect to see Wells Fargo roll out new innovations this year. Alvarado said the bank has multiple “exciting announcements” on the horizon. Long Beach customers of Wells Fargo will also benefit from a new location at the Traffic Circle, which is scheduled to open this year. The current branch at the Traffic Circle is located within Ralphs grocery store. “The larger location will provide our customers a more robust branch with more convenient ways to complete banking transactions,” Alvarado said.

Michael Miller, president and CEO of Long Beach-based International City Bank, does not expect much change for the bank this year. The institution specializes in business banking in Long Beach and has another office in Irvine.

“Our client base is continuing to do well,” Miller said. “They have rebounded after the recession and as a whole continue to perform well, which is good for us as well.”

The Federal Reserve raised its key interest rate by .25% in December and is expected to implement another increase this year. “The most recent interest rate hike was anticipated. And I think we’re anticipating that at some point between now and the end of year, there will be the likelihood of at least one more rate hike,” Miller said. “That will have somewhat of an effect on things in general, but not an overwhelming effect on how companies are performing and the additional costs associated with that interest rate hike,” he explained.

Rising interest rates may impact home mortgage rates, but Miller does not expect them to increase by much. Strong home values in the Long Beach area also serve to bolster the local housing market, he noted.

ICB may offer expanded technological service offerings in 2017. “We are exploring a couple different things in 2017, one of which may be mobile banking,” Miller said. “We’re also going to be improving and expanding our website, and that is going to start fairly soon.”

Mergers and acquisitions of California banks should continue in 2017, according to Miller. For example, in 2016 Lodi-based Farmers & Merchants Bancorp (not to be confused with Long Beach’s Farmers & Merchants Bank) acquired Delta National Bancorp, a bank headquartered in Manteca, California. In December, Suncrest Bank, based in Visalia, acquired Fresno-based Security First Bank.

“We are going to continue to see fewer banks in the State of California,” Miller said. “But banks are certainly performing well. Banks that have been acquired over the last six to 12 months, it appears that [their] multiple book value has increased,” he said, referring to the ratio of a bank’s stock valuation to its book value.

“Certainly banks are performing better as a result of the economies of scale with banks merging and gaining access to specific markets that they hadn’t penetrated before. [That] certainly improves their performance,” Miller said. “And we are looking at opportunities as we move forward. Nothing definite yet, but we are certainly looking at possibilities.”

Accountants are expecting to have a busy year thanks to possible tax policy changes by the new presidential administration.

“With the Trump administration in, we are expecting to see a lot of favorable tax changes, and so that will mean a lot more planning for our clients. So we see it as a good year,” Blake Christian, partner of accounting firm Holthouse Carlin & Van Trigt, told the Business Journal. “We are very optimistic since 70% of our fees are tied to tax consulting and tax compliance work.”

During his campaign, the president-elect outlined potential cuts to personal and corporate tax rates in part to encourage U.S. companies to move their foreign investments back home, Christian noted. “I think most of what he has laid out has a decent chance of passing,” he said. “The wild card is just the [national budget] deficit. I am hopeful that the Republicans will take deficit reduction seriously and maybe focus on that along with the tax breaks.”

As a result of tax cuts, Christian said there is likely to be increased domestic investment and job growth, rather than foreign investment, by U.S. companies. “The thing that we’re going to have to watch is probably how companies are going to grow in California versus other states with the continuing regulatory environment in California, as well as the high tax rates and minimum wage mandates,” he added.

Financial firms focused on employee benefits and investments consulting may also have a dynamic 2017. Trent Bryson, CEO of Bryson Financial, a mid-market employee benefits company based in Long Beach, said that the result of the presidential election is cause for hope for his industry this year.

“I believe that the first 90 days of the new president should prove to be interesting,” Bryson said. “But from a business standpoint, I think there is going to be some deregulation that is going to free up companies’ cash and allow them to grow. So from a market standpoint we’re looking forward to that.”

While Bryson said there are no new state regulations that he considers burdensome to the financial services industry, he did say that overall the state is “pretty tough to operate in.” He added, “California continues to chase businesses away. So you hope that the overall federal approach outweighs the business-stifling environment of California.”

If the Affordable Care Act is amended or replaced, health care costs could decrease without sacrificing coverage, Bryson said. “What it’s going to allow us and those in the financial industry to do, is to spend more time focusing on our clients and less time focusing on paperwork,” he explained.

Oil

Stabilizing Oil Prices Could Mean More Jobs And Investment

By Brandon Richardson, Senior Writer

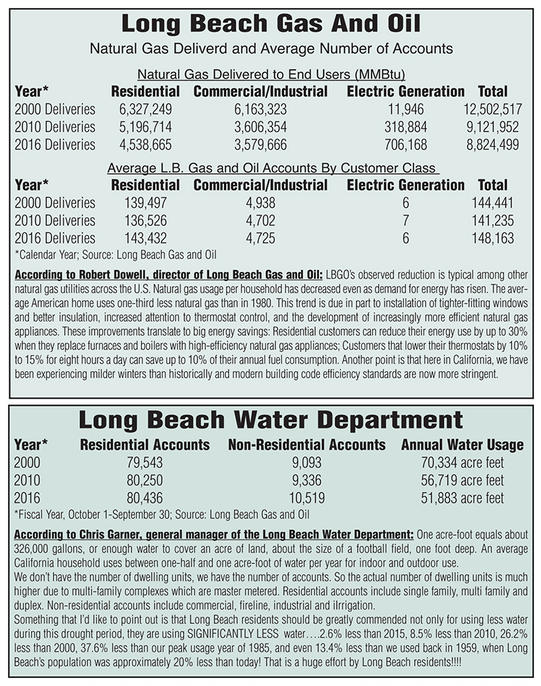

After starting 2016 with oil prices nearing $26 per barrel, a 13-year low, 2017 has much better projections with prices already above $50 per barrel, according to Robert Dowell, director of the city’s Long Beach Gas and Oil Department.

Dowell said the department is drilling about one well per month, but that activity could increase if prices sustain. He also explained that company oil production is expected to be down slightly from last year.

Signal Hill Petroleum Vice President and Chief Operating Officer Dave Slater said the increase in oil prices will allow the company to invest in drilling, which will create more jobs in the area. (Photograph by the Business Journal’s Larry Duncan)

“We’re declining about 2% to 5% on a yearly basis overall. And that’s anticipated to continue in 2017 unless there is a significant uptick in new well drilling, which would offset that decline,” Dowell said. “It’s very price sensitive.”

Though the oil industry is accustomed to pressure due to legislation and regulations, Dowell said the new Trump administration might be more favorable to the industry. In any case, Dowell explained that the oil industry has always proven resilient to regulatory challenges and has always been able to meet them while continuing exploration.

David Slater, vice president and chief operating officer of Signal Hill Petroleum (SHP), explained that California legislators have been examining regulations pertaining to idle wells and underground injection.

“The pendulum is moving toward updating older regulations to recognize today’s world,” Slater said. “At the end of the day, we’re hopeful that we wind up with the right updates to the regulations that are good for protecting the environment, the groundwater, and are good for the industry.”

With current oil prices, Slater said that SHP’s economic forecast for the year is very positive. Oil being a declining resource, Slater explained that the increased prices allow the company to invest in drilling to offset the decline and keep production for the year to around 1 million barrels.

Signal Hill Petroleum employs more than 80 people, but with increased drilling activity, Slater said new jobs would be created. Aside from the impacts on jobs and oil sales, Slater explained that oil produced in California is among the cleanest and most environmentally friendly anywhere in the world.

“California has such a high volume of consumption. We’re actually the third largest consumer in the world. It goes: the United States, China and then just California alone,” Stefanie Gillett, a communications specialist with SHP, explained. “It’s one of those things that’s not going to change, and I don’t think we want it to because we all love our lifestyle. So we just need to be smart about how we do that and if we can produce it here locally and smartly.”

With no oil pipelines connecting it to other oil-producing states, California imports 64% of its oil to keep up with consumption needs, according to Robert A. Barnes, executive vice president of operations at California Resources Corporation (CRC). Similar to SHP, stable oil prices will allow CRC to grow production at its Wilmington Field, which will increase jobs, Barnes explained.

Barnes said the company invests in technologies such as automation, environmental controls and water recycling, which contribute to its success as a leading California operator. Additionally, he explained that the company invests in drilling and production technologies to minimize its footprint.

“In an ever-changing and uncertain world, increasing California’s energy supply is the best way to ensure that all Californians have access to affordable and reliable energy,” Barnes said. “Promoting California’s energy self-sufficiency in 2017 will increase jobs, infrastructure investments and tax revenues – and can reverse our state’s record dependence on imported oil, natural gas and electricity from places that don’t match California’s high safety, labor and environmental standards.”

Utilities

Local Utilities Expect Price Changes And Improvements

By Brandon Richardson, Senior Writer

Continued improvements and the introduction of new technologies are expected for local utilities, which may alter consumption patterns and will lead to price changes for residents.

Water

Though the year has started with rainy weather throughout California, conservation is still the core message from Christopher Garner, general manager of the Long Beach Water Department.

“Long Beach residents have done a great job at continuing to conserve,” Garner said. “I believe we are 14% below the 2013 benchmark, which is incredible.”

Even with the wet start to 2017, Garner said neither he nor water experts in Sacramento are making projections, because weather patterns are fickle. He explained that last year’s failed promise of El Niño bringing an abundance of rain to Southern California has caused experts to acknowledge that it is virtually impossible to predict water levels.

“We’re just starting the real rainy season, and we’ll see where that stands,” Garner explained. “We’ve definitely had a good start with December and [so far] in January, but it’s the next two months that are really going to be the telling factor as far as where we stand coming out of this winter.”

The Long Beach Water Department plans to restructure water rates sometime midyear, according to Garner. He said that the changes will be revenue neutral in the sense that the intent is not to generate more or less money but rather to ensure it is legally defensible and fair to customers. One change is to incentivize customers to conserve by rewarding low-consumption users, while sending a financial message to those who use an inordinate amount of water, Garner explained.

The water department will also continue replacing 1,800 miles of water pipelines and 900 miles of sewer lines, a practice that has already seen an 80% drop in mainline breaks on the water side, according to Garner. Additionally, the department is considering a move to smart meters, which will provide more detailed information to the utility and its customers.

Garner said, “I think it’s a tool, if we go that route, that will have an impact on the knowledge base for our customers – on how they use their water and when they use their water – and that hopefully transfers into changes in their water usage patterns.”

Natural Gas

Long Beach natural gas prices are expected to increase in 2017, according to Robert Dowell, director of the Long Beach Gas and Oil Department. He explained that last year’s prices averaged between $2.50 and $2.70 per 1 million British Thermal Units (MMBtu), but this year they are anticipated to reach between $3.10 and $3.20 per MMBtu.

“As far as gas prices, our customers, Long Beach residents, pay the commodity price. Whatever we pay for that gas, they pay as well,” Dowell said. “There’s a bigger demand for gas nationwide. Regulations have also shut down a lot of the coal-fired power plants, so there’s more consumption of natural gas for generating purposes.”

Dowell explained that the Advanced Meter Infrastructure project would be completed by midyear. The project began early last year and makes manual readings of gas meters by city employees obsolete by allowing data to be transmitted electronically.

Between $8 million and $10 million is spent by Long Beach Gas and Oil every year on infrastructure improvements, Dowell said. For 2017, the federally regulated integrity management program has specified a pipeline replacement strategy.

“We are working pretty diligently with the public works department to stay ahead of any Measure A street improvement projects that they have,” Dowell said. “Where we have pipelines planned in the future, we will put them in in advance of any of the resurfacing work that they are contemplating so we don’t have to dig up the street twice.”

Electricity

The regional economy is forecast to experience steady job and output growth in the electric power industry, according to Eduardo Martinez, senior planner at Southern California Edison.

“Year-over-year job growth is expected to be smaller than earlier periods of the recovery (2010-2013), while new housing construction starts are expected to climb further but not reach pre-recession levels,” Martinez said.

The upgraded power plant proposed by AES Southland LLC would cut natural gas use by 50%, cutting emissions in half, and would see the removal of the long-standing smoke stacks. Once approved, AES estimates the project located at 690 N. Studebaker Rd. would be completed in 2020, at which time demolition of old facilities would begin. Above: before. Below: after. (Photograph and rendering courtesy of AES)

Growth in rooftop solar power and electric vehicles continues to have an impact on electricity consumption, Martinez explained. Additional use of rooftop solar panels will reduce consumption, while the introduction of more electric cars will increase consumption. How the two will offset each other is yet to be seen.

AES Southland LLC hopes to begin construction on its new Alamitos Energy Center (AEC) in July on the site of its current facility located at 690 N. Studebaker Rd., according to Dalia Gomez, community and public affairs manager for AES.

The new facility is expected to use 50% less natural gas, cutting emissions in half, while still delivering the same electrical service, Gomez explained. Other benefits to the project include eliminating the use of ocean water for cooling purposes; spurring nearly $1.3 billion in private investment in California’s electric infrastructure; generating 4.7 million hours in construction-related work with a payroll of over $401 million, much of which is expected to be spent locally; contributing more than $8 million annually to the local economy and generating tax revenue; and with the demolition of current smokestacks, creating far superior curb appeal.

The California Energy Commission completed the AEC hearings last year and will release the Presiding Member’s Proposed Decision this month, with a final decision expected sometime in the first quarter, according to Gomez. She said construction of the new facility is estimated to be completed by 2020, with demolition of the current plant to follow.

Aviation And Aerospace

Despite Some ‘Ups And Downs,’ Aviation And Aerospace Sectors Expect Growth

By Brandon Richardson, Senior Writer

Despite uncertainty with the price of fuel and the potential impact on profitability, the outlook for aviation is favorable with strong demand, according to Jess Romo, director of Long Beach Airport (LGB).

“We are expecting to see an increase in the load factors by all the carriers, and that’s going to translate to more profitability for [them],” Romo said. “As a consequence, if we get more people coming into the airport on those flights, that will translate to an increase on airport revenue.”

Greg McQueary, general manager for Ross Aviation in Long Beach, said the company hopes to expand this year with the purchase of land for new hangar construction. Ross Aviation took over the site on the westside of the airport previously housing AirFlite. (Photograph by the Business Journal’s Larry Duncan)

Along with increases in load factors, Romo said he expects to see continued utilization of the 50 commercial flight slots allowed by LGB’s strict noise ordinance. Romo explained that flight slot usage, which was previously underutilized, reached upwards of 90% or more last year, adding to passenger counts for the airport.

Southwest Airlines, the newest addition to LGB’s commercial carriers, plans to continue evaluating open flight slots week by week to offer service to additional destinations as allowed, according to Michelle Agnew, communication and media relations specialist for Southwest. The airline recently added Saturday and Sunday service to Denver.

Southwest will retrofit aircraft midyear as it brings on Panasonic as a secondary service provider for improved Wi-Fi services, Agnew said. Additionally, new employee uniforms will go online this summer, and new aircraft interiors will be implemented.

One recent change to LGB was the introduction of the Federal Aviation Administration’s (FAA) Southern California Metroplex initiatives. The project goal is to improve traffic flow and safety and to reduce congestion in major metropolitan areas by redesigning airspace and introducing more efficient technologies.

“They are leveraging technology and moving from a radar-based control of traffic to a global positioning [system] approach that is multifaceted for enhanced safety of the aircraft traveling between airports in the region,” Romo said. “It’s also something aimed at getting better efficiencies from the fuel standpoint in terms of how the aircraft are managed in the airspace.”

Long Beach has already modified flight arrival practices, and departure practices should be updated within two months, according to Romo. The FAA has held a number of workshops and community meetings regarding Metroplex, with one scheduled in Long Beach on Wednesday, February 8, at the Long Beach School for Adults located at 3701 E. Willow St.

Also in 2017, Romo said the airport will continue to focus on improvements, including replanting and repainting certain areas and reopening Parking Structure A after the completion of enhancements to elevators and stairwells. Romo also said a bike-share pilot program could be on the horizon for LGB.

One major question revolving around LGB is the forthcoming council decision on JetBlue Airways’ request for Federal Inspection Services and U.S. Customs facilities to be established at the airport. The decision is scheduled to be made at the city council’s January 24 meeting, two years after JetBlue’s initial request and one year after the council commissioned Jacobs Engineering to conduct a feasibility study.

Recently, Romo responded to a list of 32 questions submitted by 8th District Councilmember Al Austin regarding the impact of international flights at LGB on the noise ordinance, business and the Long Beach economy. Regardless of the decision, Romo said the airport’s only concern is offering Long Beach and surrounding area residents a great flying experience, and it has no intention of compromising the noise ordinance.

“We will continue to do our work in terms of protecting what the noise ordinance is intended to do,” Romo said. “We just want to make sure that we remain on that list of top-10 airports that we’ve been very fortunate to be on.”

The general aviation market continues to improve despite ups and downs in the aircraft deliveries in certain sectors, according to Curt Castagna, president and CEO of Aeroplex/Aerolease Group. Castagna said new leadership in Romo is exciting, as he is vibrant and brings a lot of experience and knowledge to the position.

With the permanent closure of two runways last year, Castagna said the airport has an opportunity for development. He explained that with proper planning, new development on airport property could bring more diversity, which is an opportunity many airports don’t have.

“We think those development opportunities could bring some synergy and some different revenue streams for leases and things that are complementary to the existing users,” Castagna said. “I’m just excited about the future that Long Beach has and the continued evolution of our aviation services. And we’re happy to be a part of it.”

The biggest challenge of 2017 for Ross Aviation is to assure customers they will be given the same quality of service as they received from Toyota’s AirFlite, according to Greg McQueary, general manager for Ross. AirFlite was a longtime fixed base operator (FBO) at LGB that moved operations to Texas last year, leaving many of its employees to work for Ross, which took over the facility. McQueary worked for AirFlite for 22 years.

“One of the goals is that we’d like to expand. We’d like to work with the airport to secure some additional land to possibly build some hangars,” McQueary said. “We really want to focus our attention on our base customers, as well as some of the other fractional companies that fly into the airport that normally go to our competitor.”

With a new stadium being built in Inglewood for the Rams and Chargers professional football teams, McQueary said Ross is attempting to encourage the National Football League to fly teams into Long Beach. He said bus rides might be a little longer than if they fly into LAX, but Long Beach is cheaper and easier to get in and out of.

Last year, Boeing announced the consolidation of its Defense, Space and Security division, which will bring jobs to Long Beach from its Huntington Beach facility. However, Rudy Duran, director of the Boeing Long Beach site, explained that this is a multiyear effort, meaning no positions have moved to the city and exact numbers have not been determined.

Other plans for Boeing in 2017 include the 737 MAX entering into service and flight tests of the new 787-10. The 737 MAX has already received 3,419 orders, making it the fastest-selling airplane in Boeing history, Duran said. The aircraft is 14% more fuel-efficient than today’s most efficient 737s.

“It’s important to emphasize that the Boeing footprint in California represents a vital part of the company, and the teams here are doing innovative and important work,” Duran said. “Our employees remain active and committed to the Long Beach community, contributing both dollars and time in many ways. We have great partnerships with local schools, including CSULB, and we continue to work with local organizations that support the neighborhoods in Long Beach.”

Residential Real Estate

Long Beach’s Outlook Remains Positive, Similar to 2016

By Samantha Mehlinger, Assistant Editor

Despite a small interest rate increase by the Fed, local residential real estate professionals expect Long Beach’s single-family and multi-family properties to remain in high demand this year. Both real estate markets continue to experience low inventory of properties for sale, which is continuing to put pressure on sales prices and rents, and increase property values. As a result, housing affordability remains an issue both for homebuyers and renters.

Single-Family Homes

Long Beach’s single-family home market continues to experience low inventory and high demand, a dynamic that is driving increasing sales prices. Local real estate experts expect this trend to continue through 2017. They also remain hopeful that the new presidential administration will consider reforms to improve housing affordability and availability, which are lacking locally and throughout the Southern California region.

“We closed the year with about 2.1 months in single-family inventory, and I don’t see anything on the horizon that is going to cause any significant change in that,” Geoff McIntosh, president of the California Association of Realtors (CAR) and owner of Long Beach’s Main Street Realtors, told the Business Journal.

An offer is pending on this home at 5490 E. The Toledo, listed by Coldwell Banker Coastal Alliance in Long Beach’s Naples neighborhood. The home is listed at $7.49 million. While the overall inventory of homes for sale in Long Beach is low, there are more high-end homes for sale than there are entry-level and mid-priced homes. (Photograph by the Business Journal’s Larry Duncan)

“We did see a modest interest rate increase,” McIntosh said, referring to the Federal Reserve’s move to raise interest rates by a quarter of a percent in December. That caused 30-year fixed home mortgage rates to increase by about an eighth of a percent, he noted. “We had some concern that that might have a negative effect on the market, but the increase ended up being so small that it was pretty quickly absorbed by the pool of buyers looking for property.”

It is likely that low inventory is going to be the new normal locally, according to Phil Jones, managing partner of Coldwell Banker Coastal Alliance and an active member of CAR and the National Association of Realtors. “I think it’s safe to say that 2.5 to 3 months is going to be the new norm,” he said.

McIntosh pointed out that there is hardly any construction of new homes in the area. There are single-family communities planned near Bixby Knolls and on the eastern edge of the city, but they have not broken ground yet. “The limited new construction that is available tends to be upper end. That’s not where we need the inventory,” McIntosh noted.

Increasing interest rates and home prices restrict the affordability of housing, Jones explained, adding that he expects Long Beach home prices to increase between 5% and 10% this year.

As of November, the median price of homes for sale in Long Beach was about $595,000, according to McIntosh. Statewide, CAR expects home prices to appreciate between 3.5% and 4% this year, he said. In Long Beach, he expects to see a 5% increase. Locally, the median price of condos increased to about $330,000 in 2016, a 4.6% increase from 2015.

As of November, 31% of California households could afford to purchase a home at the statewide median price of $515,940, according to CAR. Forty percent of Californians could afford a median-priced condo or townhome at $418,230.

Moving forward, Jones said he hopes the next presidential administration will recognize the importance of the housing market to the overall economic recovery. “I don’t believe that the Obama administration really grasped that,” he said.

“One way that we will benefit is the new administration has specifically stated they are going to make changes to the Dodd-Frank bill and even specifically the Consumer Financial Protection Bureau,” Jones said. Changes in these areas could help both large and small banks have more confidence in making loans. Banks have been somewhat paranoid and restrictive in making loans because of a confusing and burdensome regulatory environment, he explained.

McIntosh said reforming government-sponsored Freddie Mac and Fannie Mae is on President-elect Donald Trump’s agenda but will not likely be addressed this year. “They have bigger fish to fry,” he said.

The California Association of Realtors has been working toward easing regulations for condo complexes to get recertified for Federal Housing Administration financing. This would aid in housing affordability, as condos are considered entry-level product for homebuyers. “We hope that under the leadership of Dr. Ben Carson we will be able to make some headway, although it’s kind of hard to tell,” McIntosh said.

Multi-Family Properties

In Long Beach, the recovery from the Great Recession has been marked by years of swiftly rising demand for hard asset investments like apartment buildings. Owners waiting for values to top out have been slow to sell their properties, resulting in a market crunch with high demand and very low inventory, as local brokers tell it. Despite high prices driven by this dynamic, buyers have still been benefiting from low interest rates. This year, however, interest rates are expected to be on the rise, which might loosen up the market a bit.

Local multi-family real estate professionals expect the Fed to issue one or more rate increases during 2017, which will affect the interest rates for property loans.

“Especially after the election, pretty much everybody is singing from the same song sheet that we’re going to get a series of rate increases this year,” Eric Christopher, senior investment associate with INCO Commercial, said. “We’re starting to see a little bit more momentum building off of that catalyst.”

According to Christopher, prices for multi-family properties typically decrease when interest rates rise. Before rates increase again, Christopher said it’s likely that more property owners will list their buildings for sale to take advantage of nearly top market prices.

“Sales activity has actually been pretty active at the end of the year and pretty active going into this new year,” Steve Bogoyevac, first vice president of investments with the Long Beach office of Marcus & Millichap, said. “We’ve got a market that is still very active. There is still a lot of money chasing after apartment deals,” he observed.

So far, the December interest rate increase has not impacted property values or deterred buyers, according to Bogoyevac. “Everyone thought that these rates going up was going to cause things to slow down or cool off, but it hasn’t,” he said. More property owners may put their properties on the market this year, which would help grow inventory somewhat, he added.

New apartment developments in Long Beach, which are mostly concentrated in downtown, represent a confidence in the multi-family market here, Bogoyevac noted. “Locally, I think the continued development . . . will have a positive effect on the overall apartment market,” he said.

Both Bogoyevac and Christopher believe rents will continue increasing in Long Beach this year. “Most of the guys and gals I talk to, when they think of a rent increase, they’re thinking about 7% to 10% of what they are getting now,” Christopher said. “Employment numbers are good. The incomes are there for more rent.” Rising rents are likely to continue driving the conversation about rent control among local housing advocates, he noted.

Commercial Real Estate

Markets See Continued Positive Leasing Trends

By Brandon Richardson, Senior Writer

With the stock market rallying, the economy continuing to see the addition of jobs and the forthcoming inauguration of a new presidential administration, local commercial real estate markets remain strong.

Office

Demand for office space is often a lagger in the economy and follows the employment trend, according to Robert Garey, director at Cushman & Wakefield. He explained that as employment continues to improve around the country and locally in Long Beach, demand for office space will grow in tandem.

“I think the forecast is going to be more of an upward trend, positive leasing activity, which is going to reduce vacancy, which will increase rental rates and increase property values,” Garey said. “I think the trend is going to be good for 2017. I don’t see anything that’s going to hang it up.”

Late last year, Mercedes-Benz USA LLC leased the building located at 4031 Via Oro Ave. within the Freeway Business Center office and industrial complex. The building, consisting of more than 85,500 square feet, is located adjacent to a another building at 4035 Via Oro currently used by Mercedes-Benz for research and development. The company could not be reached for comment regarding the anticipated use for the space and the number of employees who will work at the site. (Photograph by the Business Journal’s Larry Duncan)

Recent expansions by Molina Healthcare at 1500 Hughes Way and a lease by Mercedes-Benz of an entire 85,000-square-foot building at 4031 Via Oro are indicators of the strong demand in the Long Beach market, Garey said.

Garey said it will be interesting to see what happens to markets with the new Trump presidency, but added that the stock market rallying is a good indicator of the next 12 to 18 months. He said he thinks rental rates and property values are likely to increase, but will depend on interest rates.

Some of the best-selling commodities on the office market are spaces of 3,000 square feet or less, according to Becky Blair and Roy Gaut, president and associate at Coldwell Banker Commercial BLAIR WESTMAC, respectively.

“Office space under 1,000 square feet tends to lease very quickly. We get multiple calls a day on our vacancies, and they don’t sit on the market very long,” Gaut said. “[We’ve seen] professionals like attorneys and therapists, and we’ve really seen a lot of medical users pick up recently. Medical office has taken off.”

Blair explained that she has already noticed an uptick in the smaller space activity from last year and that she expects this trend to continue throughout the year. Because of this trend, Gaut said some of the landlords he works with are considering breaking down some larger vacancies into smaller offices with the hopes of raising occupancy.

According to Blair, it is wise and profitable for small businesses to purchase their office space rather than leasing, especially in a marketplace as stable as Long Beach.

“I think we increased about 15% to 20% on pricing last year. And I would say that it’s going to probably stabilize this year on the sales side because the interest rates will go up,” Blair said. “But we’re still going to see the pace be strong. I think we’ll do very well, but I don’t think that we’ll see the increases we have over time.”

Retail

With a growing population and average household incomes on the rise, the Long Beach retail real estate market is becoming evermore desirable for businesses, according to Brian Russell, vice president of Coldwell Banker Commercial BLAIR WESTMAC.

“In general, for retail space in particular, I’m bullish on Long Beach,” Russell said. “I think it’s going to continue to attract good, strong retailers because we have good, strong, stable demographics.”

Though the overall market is strong, with areas like Bixby Knolls continuing to attract good tenants, Russell explained that some areas are experiencing a price ceiling, where asking lease prices have reached their peak. He said this is evident in areas such as Belmont Shore where there is an unusual number of vacancies, when space in the past has been leased quickly.

Russell said that the passing of Measure MM to allow medical marijuana distribution within Long Beach city limits would also play a role in the 2017 retail market as vendors are approved to enter the city. He explained that most real estate agents do not fully understand the “rules of engagement” when it comes to leasing to medical marijuana distributors but that the city attorney is scheduled to speak to the Long Beach Commercial Real Estate Council in March.

Another key factor in the retail market this year will be big box retailers such as Sears, Kmart and Macy’s going dark, according to Doug Shea, president of INCO Commercial. With large retail chains closing their doors this year, in addition to Sports Authority and Sport Chalet, which closed last year, there is a lot of retail space that will need to be filled.

Shea explained that his company recently started a self-storage division, which he thinks may be one way to eliminate the new space.

“A lot of that will have to do with the proper zoning or changing zoning or getting a variance. But today’s retail isn’t giant boxes as much as it used to be,” Shea said. “I see that as having a big impact on 2017 – a lot of spaces needing to be filled due to the downsizing or bankruptcy of large companies.”

As for restaurant space, Shea explained that he still sees them moving around a lot but that there are always inquiries from new businesses to make their way into the Long Beach market. However, second-generation space appears to be desired by most restaurateurs, as opposed to building a new facility from the ground up.

The announcement that Real Mex Restaurants closed some of its restaurants, including the El Torito at 6605 E. Pacific Coast Hwy., marked the second large restaurant to close at the Marketplace Long Beach during the past year.; the other was the Tilted Kilt Pub & Eatery. Shea said that the landlords are currently thinking of dividing the former El Torito location into two restaurants and the former Tilted Kilt location into four fast-casual establishments.

Despite businesses closing and the trend toward smaller space, Shea said sales and leasing of retail would remain steady, as will the prices.

Industrial

The local industrial real estate market will be similar to 2016 in a lot of respects, according to Lance Ryan, senior vice president of marketing and leasing for Watson Land Company. Ryan anticipates a continued lack of supply across all size ranges, along with a very solid demand.

“In general, the outlook is very low vacancy, increased and continuing pressure on rental rates and downward pressure on concessions to make lease deals,” Ryan said. “A lot of these fundamentals are really exacerbated by the lack of supply of land for industrial development.”

Even with several projects poised to add industrial space to the market, including sites at Douglas Park, Ryan said it is not of a scale to really impact the vacancy rates. With the pressures of low vacancy rates, rental rates are expected to increase between 5% and 10%, the same as last year, according to Ryan.

The new 40,000-square-foot headquarters for United Pacific, formerly United Oil, is scheduled for completion by May at Douglas Park. Currently based in Gardena, United Pacific owns, operates and supplies gas station convenience stores throughout the Western U.S. (Photograph by the Business Journal’s Larry Duncan)

In addition to a vacancy rate around 1% to 2% and increasing rates, Ryan explained that there is downward pressure on concessions by property owners, meaning they will be less likely to contribute improvement dollars. Because of these trends, existing customers are trying harder to reach renewal agreements prior to their expiration date.

“I think the election really changed things,” Brandon Carrillo, principal at Lee & Associates Commercial Real Estate Services, said. “A lot of businesses thought Hillary [Clinton] was going to get elected and we were going to have another four years of the same old thing. Trump getting elected has really brought enthusiasm back to business – local businesses, as well as nationally.”

Carrillo said that a local aerospace manufacturer he has been working with was considering moving to Texas but has decided to explore options to stay in Long Beach. He explained that the company is interested to see how Trump puts pressure on California in regards to regulations.

The Douglas Park development north of the Long Beach Airport continues to attract businesses to relocate their headquarters to Long Beach. Currently under construction is a hotel project along Lakewood Boulevard, a headquarters office for a company currently based in Gardena, three industrial buildings across Lakewood Boulevard called Pacific Pointe East being built by Sares-Regis Group and a couple of spec buildings by the development company. Groundbreaking ceremonies were held recently for the Terminal at Douglas Park to house four two-story creative office buildings, each totaling 25,000 square feet. To the far north of the property at Lakewood Boulevard and Carson Street, Burnham USA purchased nearly 27 acres from Sares-Regis to develop a retail center known as Long Beach Exchange (LBX). (Business Journal photograph by John Robinson taken in early December 2016)

Factors such as uncertainty at the port with the recent bankruptcy of Hanjin Shipping were a concern to industrial space users, but a quick resolution only produced greater optimism in the strength of the economy.

However, Ryan said that he expects the industrial market to remain tight for the foreseeable future, which raises the risk of losing businesses wanting to expand. He explained that Long Beach currently does not have the product for companies to grow and expand but that the Inland Empire is in the midst of a construction boom, which could cause growing companies to relocate.

“The other thing that’s going to be interesting heading into this new year is Measure MM and the whole medical marijuana cultivation and laboratory stuff,” Carrillo said. “It’s going to be an interesting year here locally as we try to figure out how these medical marijuana guys play in.”

Retail

Technology And New Laws Poised To Affect Local Retail Stores And Restaurants

By Brandon Richardson, Senior Writer

The continued utilization of old and new technology, as well as new laws and regulations, will have an impact on local retail stores and restaurants, according to industry experts.

Restaurants are expected to see the continued use and growth of online ordering and third-party delivery services, such as GrubHub and Postmates, in the upcoming year, Sharokina Shams, vice president of marketing and communications for the California Restaurant Association, said.

A rendering depicts the concept design for improvements to a shopping center at 3rd Street and Redondo Avenue. (Rendering provided by Pacific Collective Real Estate Investments)

“Those services are great, though the overall idea of third-party delivery is something that restaurant owners go back and forth on whether it is a good idea or a bad idea,” Shams explained. “There’s some kinks being worked out, but with the increased use of tech, there is certainly no indication that third-party delivery is going to go away. That’s here to stay and we think it’s going to grow.”

One report Shams said she received also indicated a growth in restaurant loyalty programs to encourage customers to return often. Shams explained that full-service restaurant sales decreased in 2016, a trend that is estimated to continue this year to the tune of about a 2% drop. On the other hand, quick-service restaurants and fast-casual chains continue to outperform full-service locations.

“While there’s a lot of things you can do at home now, including ordering groceries and ordering toys and clothes and holiday gifts, restaurants are still a place that attract people to leave their houses,” Shams said. “We’re hoping that will mean an uptick in foot traffic this year in restaurants, but that remains to be seen.”

The Long Beach Marketplace in Southeast Long Beach recently lost its El Torito restaurant when owner Real Mex Foods shuttered it along with five other El Toritos in the Southland. The restaurant was one of the original tenants when the center opened in the late 1970s. Trade Joe’s is one of the anchors of the Marketplace. (Photographs by the Business Journal’s Larry Duncan)

Technology is also playing a major role when it comes to shopping. As big names such as Amazon continue to thrive with sustained growth in online sales, new tech-focused ventures are beginning to impact the retail world.

“Online sales have continually affected the retail market. Already we have seen a shift in tenants from merchandise-related retailers to service-related retailers,” Joe Linkogle, vice president of investment and director of Marcus & Millichap’s National Retail Group, said. “Food-related tenants, as well as other service-related tenants such as beauty parlors and nail salons, will continue to dominate the demand for good retail space.”

The new grocery store Amazon Go is scheduled to open to the public early this year and is already open to Amazon employees in Seattle. The innovative concept revolves around a grocery store with no checkout lines. Instead, customers scan items using a mobile application and are billed electronically. It is yet to be seen how expansive the concept will be moving forward, but it has already made waves as a change in the shopping experience.

Trader Joe’s is one of the anchor tenants at the Long Beach Marketplace shopping center. (Photograph by the Business Journal’s Larry Duncan)

Locally, the outlook for retail investment is very good, according to Linkogle. One major change to Long Beach retail in the coming months will be the introduction of medical marijuana facilities.

With the passing of Measure MM, Linkogle said he has received numerous calls from marijuana distributors about retail opportunities as they search for locations that fall within the zoning requirements defined by the measure.

Additionally, this year men are expected to continue to outspend women, and the menswear market is anticipated to expand 8.3% in light of that trend, according to a Forbes article by Bryan Pearson titled “7 Under-The-Radar Retail Trends For 2017.” The introduction of artificial intelligence to create a more targeted and personalized shopping experience, an increase in contactless payment methods through mobile devices and an increased desire to shop small and local are among other expected trends for this year.

Hospitality And Tourism Industries Prepare For

Another ‘Record-Breaking Year’

By Brandon Richardson, Senior Writer

Coming out of 2016, which was described as the “best year ever” for hospitality and tourism by the Long Beach Area Convention & Visitors Bureau (CVB), Steve Goodling, the president and CEO of the CVB, said he has high hopes for 2017.

“Overall, the year is shaping up to deliver at least another million dollars to the special advertising and promotions fund [monies procured through the tax on guestrooms, such as hotel rooms], taking it up to over $27 million,” Goodling said.

The 241-room Hampton Inn/Homewood Suites dual hotel project at Douglas Park will be completed mid-year according to Larry Lukanish, senior vice president at Sares-Regis Group. (Photograph by the Business Journal’s Larry Duncan)

Already this year, the CVB hosted The Special Event, a convention that drew more than 5,000 professionals from the special event industry. Goodling explained that the event was a great opportunity to showcase the recent and continued enhancements to the convention center, as well as the city as a whole, to an entire industry.

A good barometer for the success and health of the industry is the fact that the schedule for convention center event spaces is practically full. Goodling explained that his office recently received a request for space in March and April, but only two days were available.

The continued enhancements to convention and event spaces by the city and the CVB are a main driver in attracting newer conventions that target younger generations, according to Goodling. Such is the case with a new addition to the convention lineup for 2017, TwitchCon.

Originating in San Francisco in 2015, TwitchCon is centered on a platform that allows gamers to livestream their video game play and chat with viewers in real time. Last year’s event was held in San Diego; however, Long Beach won the contract for this year due to its proximity to three airports, the number of restaurants in the vicinity of the convention center and by offering the best hotel prices for convention goers, according to a company statement. Goodling explained that more than 15,000 people are expected to attend the event, which is scheduled for October 20-22.

Events such as TwitchCon will contribute to the city’s overall room occupancy, which is expected to increase from last year, according to Bruce Baltin, managing director of CBRE Hotels.